Decoding Offshore Company Formation: Checking Out Benefits and the Performance Process

In the world of international company undertakings, the idea of overseas firm formation often intrigues business owners and corporations looking for critical benefits. The elaborate web of laws and advantages bordering this process needs a careful understanding to navigate successfully. Looking into the ins and outs of offshore company development clarifies the advantages that can be used and the subtleties of the operating procedure - Offshore Company Formation. As we start dissecting this diverse topic, a deeper understanding awaits those interested about opening the prospective possibilities that exist beyond borders.

Advantages of Offshore Business Formation

Offshore firm formation offers many advantages to organizations seeking to expand their procedures globally. One key benefit is tax obligation optimization. By establishing a visibility in a jurisdiction with beneficial tax obligation laws, companies can legally reduce their tax obligations, resulting in increased earnings. In addition, offshore firms often enjoy better privacy and confidentiality concerning their financial affairs. This can be specifically beneficial for businesses operating in sectors where discretion is essential.

Additionally, setting up an overseas business can offer possession protection. Possessions held by an offshore entity may be secured from dangers such as suits or personal bankruptcy in the firm's home nation. This safeguarding of assets can provide assurance to entrepreneur and investors. One more advantage is the versatility in company structuring that offshore company formation allows. Firms can select from an array of lawful frameworks to finest fit their functional needs and strategic goals.

Tax Benefits and Incentives

When establishing a firm in a jurisdiction with beneficial tax regulations, organizations can tactically lower their tax concerns while conforming with lawful requirements. Offshore business development offers numerous tax benefits and rewards that can benefit organizations seeking to maximize their monetary procedures.

Additionally, overseas jurisdictions frequently provide tax obligation rewards such as tax obligation exceptions on capital gains, dividends, and inheritance. These motivations can draw in foreign financial investment and advertise economic development within the jurisdiction. In addition, some offshore places offer privacy and personal privacy concerning economic information, which can be useful for companies looking to secure their assets and preserve anonymity.

Lawful Requirements and Documents

Given the tax obligation advantages and motivations linked with establishing a firm in a territory with positive tax laws, it is crucial to understand the legal requirements and documentation needed for overseas firm development. When establishing up an overseas company, one have to adhere to the laws of the chosen territory, which frequently consist of providing in-depth information regarding the company's supervisors, shareholders, and activities. Looking for professional help from lawful experts or business solution suppliers acquainted with offshore company development can aid navigate the detailed legal demands and make certain compliance with all required paperwork.

Choosing the Right Jurisdiction

Picking the appropriate jurisdiction is an important choice in the process of developing an offshore company. The choice of jurisdiction can dramatically affect the success and efficiency of the business's procedures. When selecting the right territory for an overseas business, numerous factors should be taken into consideration. These consist of the legal and governing framework of the territory, tax ramifications, political security, credibility, and the level of privacy and confidentiality supplied.

One crucial element to consider is the governing and lawful framework of the jurisdiction. It is vital to pick a territory that supplies a steady legal atmosphere with clear regulations that support company activities. Furthermore, comprehending the tax obligation ramifications of the territory is important. Some territories provide beneficial tax obligation routines for offshore business, which can result in significant price financial savings.

Moreover, the political stability of the jurisdiction should not be forgotten. A politically secure jurisdiction offers a safe and secure setting for service operations and minimizes the threat of interruptions. The online reputation of the jurisdiction is likewise essential, as it can impact the reputation and dependability of the overseas company. Finally, thinking about the degree of personal privacy and confidentiality offered by the territory is essential, particularly for firms seeking to shield sensitive information and possessions. By meticulously examining these variables, companies can make an educated decision when picking the best territory for their offshore procedures.

Step-by-Step Refine of Development

Establishing an offshore company includes a systematic process that calls for careful interest to detail and adherence to details legal needs. The initial action in creating an overseas firm is picking the suitable territory based basics on factors such as tax obligation legislations, political stability, and privacy policies. As soon as the jurisdiction is picked, the next action typically entails conducting due persistance and offering the essential documentation, which might include evidence of service, identification, and address activities.

After successful registration, the last action in the development procedure entails getting any type of needed licenses or permits to conduct organization legitimately in the selected jurisdiction. Throughout the entire process, it is crucial to look for support from legal and monetary professionals to make sure conformity with all regulations and to make the most of the advantages of developing an overseas company.

Final Thought

In verdict, overseas company formation uses numerous benefits such as tax benefits, lawful incentives, and possession defense. Understanding the legal needs and choosing the ideal jurisdiction are critical steps in the process. By adhering to a detailed approach, individuals can effectively develop an offshore firm. It is essential to meticulously consider read the full info here all aspects of offshore company development to optimize its benefits and make certain conformity with laws.

Given the tax obligation benefits and rewards connected with establishing a business in a jurisdiction with positive tax obligation laws, it is important to comprehend the legal requirements and documentation needed for overseas business development. When setting up an offshore firm, one should adhere to the guidelines of the selected jurisdiction, which often include giving in-depth info about the business's shareholders, supervisors, and activities.Choosing the suitable territory is an essential decision in the procedure of developing an offshore business. Some jurisdictions use favorable tax obligation regimes for overseas go to my blog firms, which can result in considerable price savings.

Daniel Stern Then & Now!

Daniel Stern Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Charlie Korsmo Then & Now!

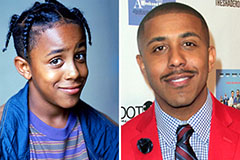

Charlie Korsmo Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now!